Choosing insurance without comparing plans is one of the biggest mistakes people make. Many beginners end up paying more money for less coverage simply because they don’t understand how insurance comparison works.

This insurance comparison guide will help you compare insurance plans step by step, avoid common mistakes, and choose the best policy for your needs.

What Is Insurance Comparison?

Insurance comparison means checking multiple insurance plans side by side to find the one that offers:

- Better coverage

- Lower cost

- Reliable claim support

- Suitable benefits

Instead of buying the first plan you see, comparison helps you make a smart decision.

Why Insurance Comparison Is Important

Comparing insurance plans helps you:

- Save money

- Get better coverage

- Avoid hidden charges

- Understand policy terms

- Choose the right provider

Two plans with the same price can have very different benefits.

Key Factors to Compare Insurance Plans

Before buying any insurance, always compare these factors.

1. Coverage Benefits

Coverage is the most important part of any insurance plan.

What to Check:

- What is covered

- What is not covered

- Maximum coverage limit

Always choose coverage based on your needs, not just price.

2. Premium Cost

The premium is the amount you pay regularly.

Tips:

- Don’t choose the cheapest plan blindly

- Balance cost with coverage

- Check monthly vs yearly payments

A slightly higher premium can offer much better protection.

3. Policy Exclusions

Exclusions are situations where insurance will not pay.

Examples:

- Pre-existing conditions

- Certain accidents

- Specific treatments

Always read exclusions carefully to avoid surprises.

4. Deductibles

A deductible is the amount you pay before insurance starts covering costs.

Important Points:

- Higher deductible = lower premium

- Lower deductible = higher premium

Choose a deductible you can afford in emergencies.

5. Claim Process & Settlement Ratio

A good insurance plan is useless if claims are difficult.

Check:

- Claim settlement ratio

- Claim processing time

- Customer reviews

Fast and fair claim support is very important.

6. Insurance Provider Reputation

Always choose a trusted insurance company.

Look For:

- Years in business

- Customer feedback

- Financial stability

Reliable companies handle claims better.

How to Compare Health Insurance Plans

Health insurance needs careful comparison.

Compare These Points:

- Hospital network

- Cashless treatment

- Coverage for medicines

- Emergency services

Health insurance should cover major medical expenses.

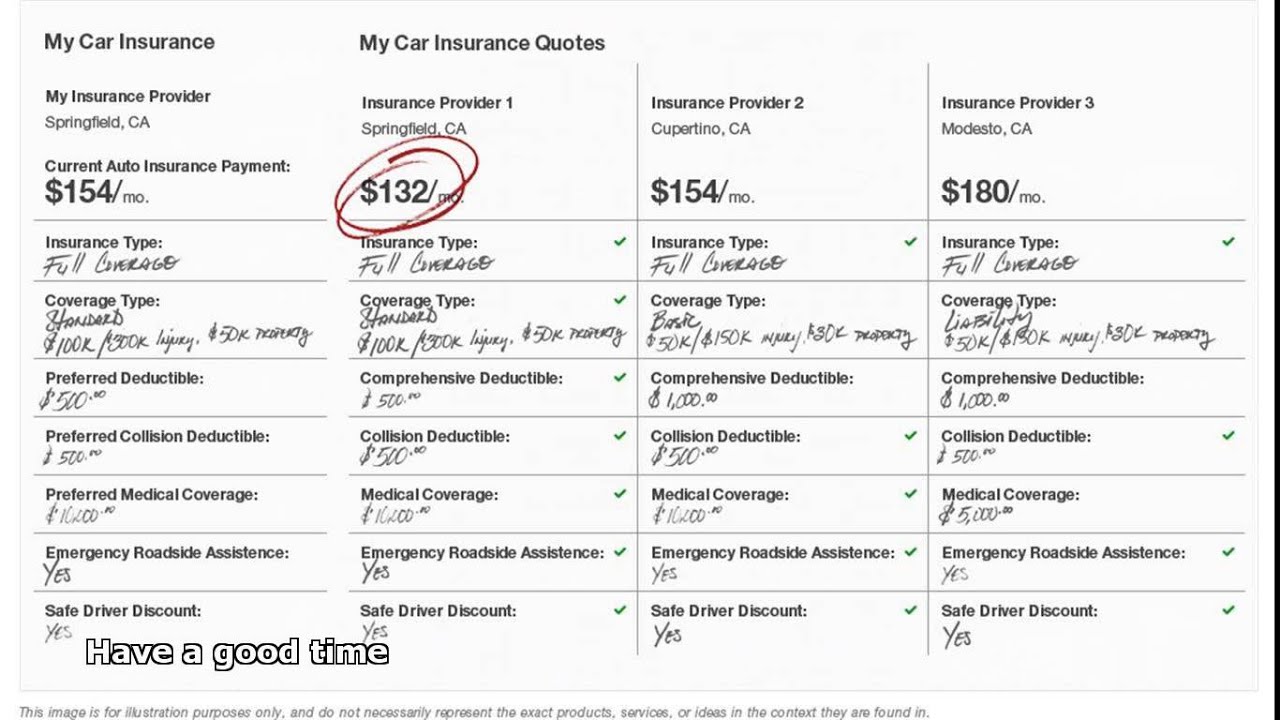

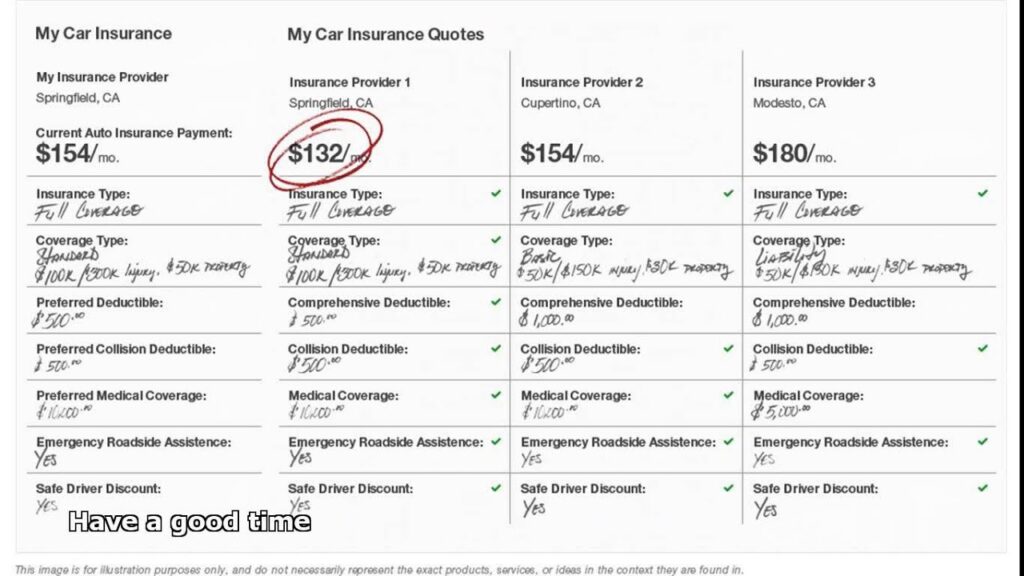

How to Compare Car Insurance Plans

Car insurance comparison is simpler.

Check:

- Third-party vs comprehensive coverage

- Accident protection

- Theft coverage

- Roadside assistance

Choose based on how often and where you drive.

How to Compare Life Insurance Plans

Life insurance is long-term.

Focus On:

- Coverage amount

- Policy duration

- Premium affordability

- Claim history

Term insurance is usually best for beginners.

Online vs Offline Insurance Comparison

Online Comparison:

- Faster

- Transparent

- Easy to compare multiple plans

- Often cheaper

Offline Comparison:

- Personal assistance

- Limited options

- Often higher cost

Online comparison is better for beginners.

Common Insurance Comparison Mistakes ❌

- Comparing only price

- Ignoring exclusions

- Not checking claim support

- Choosing unnecessary add-ons

- Skipping policy details

Smart comparison saves money and stress.

Best Tools for Insurance Comparison

You can compare insurance using:

- Official insurance websites

- Comparison platforms

- Insurance calculators

Always verify information from official sources.

When Should You Compare Insurance Plans?

Compare insurance:

- Before buying a new policy

- Before renewing insurance

- When your life situation changes

Regular comparison helps you stay updated.

Final Thoughts

This insurance comparison guide helps you understand how to compare insurance plans correctly. The right comparison can save you money, improve coverage, and give peace of mind.

Never rush when buying insurance—compare, analyze, and choose wisely.